40+ 30 year conventional mortgage calculator

Although PenFed Credit Union historically averages 30 to 40 days for purchase closings the lender says it will make an effort to close in a shorter time. As opposed to the US.

Safe Withdrawal Rates In Canada For Any Retirement Age Million Dollar Journey

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

. Use this calculator to figure your expected initial monthly payments the expected payments after the loans reset period. When it comes to 15-year mortgage rates they predict an average between 3. At least 1 number 1 uppercase and 1 lowercase letter.

If one looks exclusively at purchases FRMs are about 90 of the market. Where the most common type is the 30-year fixed-rate open mortgage. Must contain at least 4 different symbols.

As for payment terms the most common ones are 30-year terms. 30-45 business days VA loans. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

Conventional 30 year fixed. Mortgage Insurance Premium MIP is required for all FHA loans and Private Mortgage Insurance PMI is required for all conventional loans where the. A Monthly Chartbook released in June 2020.

It is the second most purchased type of mortgage product next to 30-year fixed-rate loans. Todays national mortgage rate trends. But by doing enough.

The Islamic mortgage loan cancels any form of. Assuming you have a 20 down payment 20000 your total mortgage on a 100000 home would be 80000. If one looks at the market as a whole the popularity of using 15-year FRM to refinance makes the overall market composition look a bit more even than it would without refis.

Thats about two-thirds of what you borrowed in interest. Meaning that Muslims cannot use conventional mortgages. ASCII characters only characters found on a standard US keyboard.

Not based on your username or email address. Historical 30-YR Mortgage Rates. Compare those payments to the payments you get.

Do this by multiplying the loan amount by the mortgage insurance rate. 10-60 business days USDA. 6 to 30 characters long.

The Early-2017 Guide to Buying a Home March 10 2017. 10-year mortgages tend to be priced at roughly 05 to 10 lower than 30-year mortgages. 2727 APR FICO score 700-759.

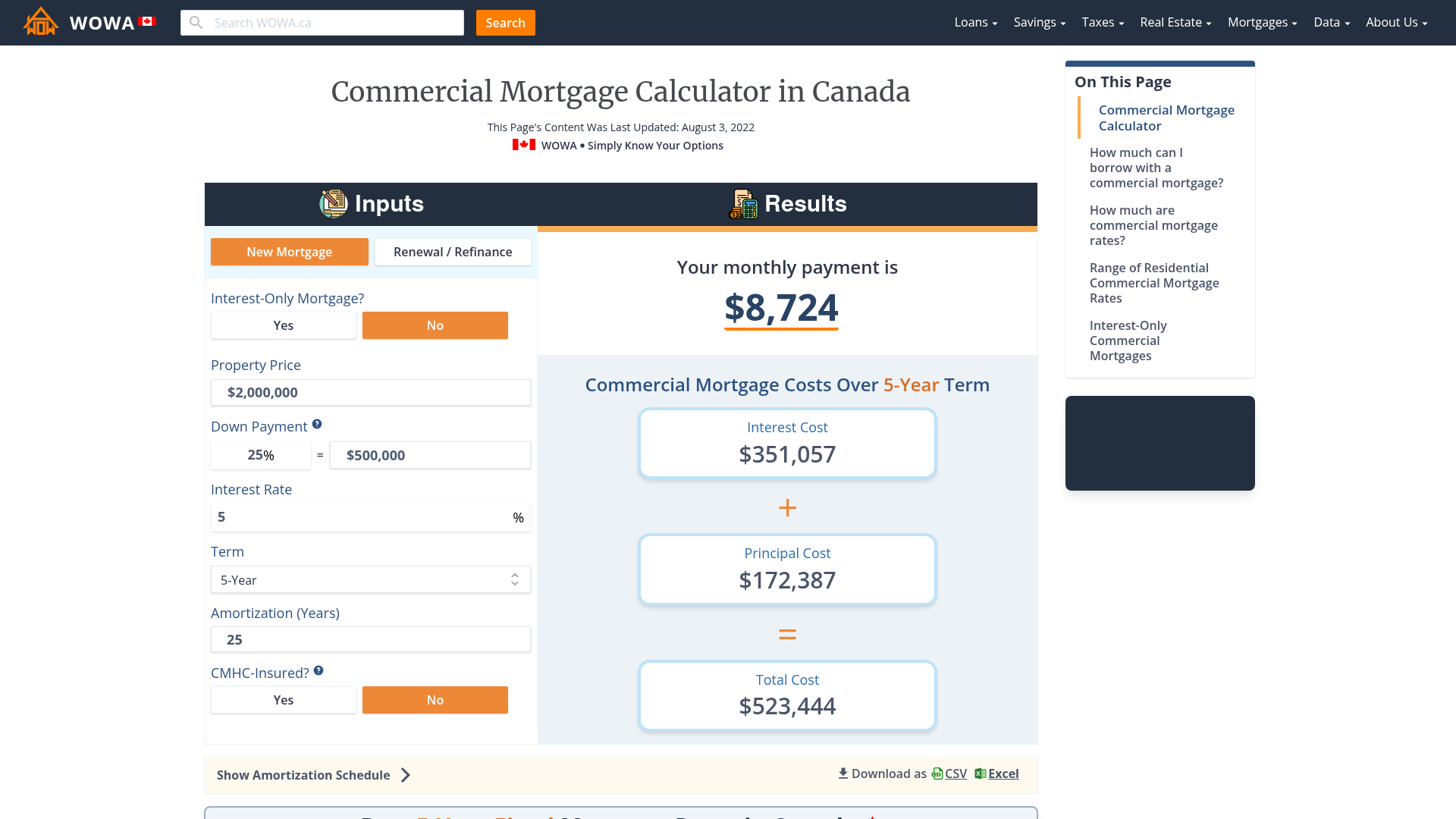

Looking for a favorable commercial mortgage deal can get overwhelming. As for 30-year fixed-rate mortgages Urban Institute reported that it. 30 year fixed FHA.

Simple Mortgage Calculator. 30 years the loan amount and the initial loan-to-value ratio or LTV. Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer.

You can use the following calculators to compare 10 year mortgages side-by-side against 15-year 20-year and 30-year options. Opting for this loan structure means that 30-year mortgage rates today will not change for the full term of the loan. This is because loans with longer terms come with cheaper monthly payments.

A mortgage of 300000 will cost you 1620 per month in interest and principal for a 30-year loan and a fixed 4 interest rate. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 359 monthly payment. By 1984 ARMs accounted for about 60 of new conventional mortgages.

Here if the remaining value of your loan was 225000 and the mortgage insurance rate was 0052 or 52 then. For today Sunday September 18 2022 the current average rate for the benchmark 30-year fixed mortgage is 628 up 17 basis points over the last seven. Thinking of getting a 30-year variable rate loan with a 7-year introductory fixed rate.

By the end of next year these industry experts predict 30-year fixed mortgage rates could rise to between 34 and 41. Program Mortgage Rate APR Change. Useful Tips Before Applying for a Commercial Loan.

Thats about two-thirds of what you borrowed in interest. The German Bausparkassen have reported nominal interest rates of approximately 6 per cent per annum in the last 40 years as of 2004. Find average mortgage rates for the 30 year jumbo fixed mortgage from Mortgage News Daily and the Mortgage Bankers Association.

However its important to know what options are out there so you can narrow down your search. Your total interest on a 350000 mortgage. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

A 30-year fixed mortgage would have 360 payments 30x12360. 045 percent to 105 percent depending on the loan term 15 years vs. Your total interest on a 600000 mortgage.

Fixed-Rate Mortgages FRM Historically the most widely purchased type of loan is a 30-year fixed-rate mortgage. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. Your total interest on a 400000 mortgage.

30 year fixed FHA. Mortgage Options That Offer 30-Year Fixed-Rate Loans. Use our free mortgage calculator to estimate your monthly mortgage payments.

Conventional 30 year fixed. 30-year fixed mortgage FICO score 760-850. But you may also obtain 20-year 15-year and 10-year terms.

You can practically get a 30-year fixed-rate loan from most mortgage lenders. 15-Year Vs 30-Year Mortgage Calculator. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

Annual mortgage insurance premium. You can obtain 30-year fixed-rate loans from the following types of conventional loans and government-sponsored. The following table lists historical average annual mortgage rates for conforming 30-year mortgages.

In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. 040 014 313 233. At 6 fixed interest that amount rises to 1986.

First determine the annual mortgage insurance amount. Calculator Rates 7YR Adjustable Rate Mortgage Calculator. This data is based on Housing Finance at a Glance.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. If you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. If anything the above tables understate the current dominance of the 30 year FRM.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. Your annual mortgage insurance payment would be 1170. 225000 x 0052 1170.

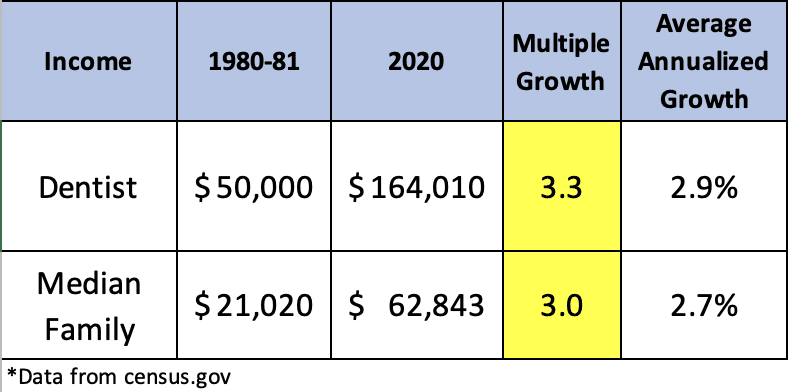

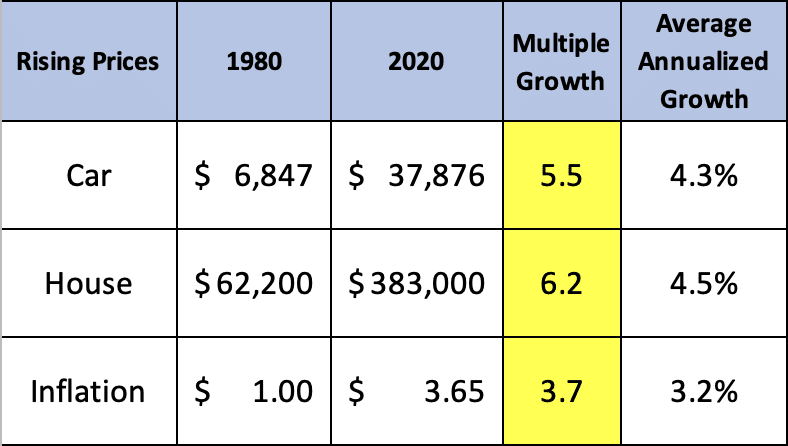

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

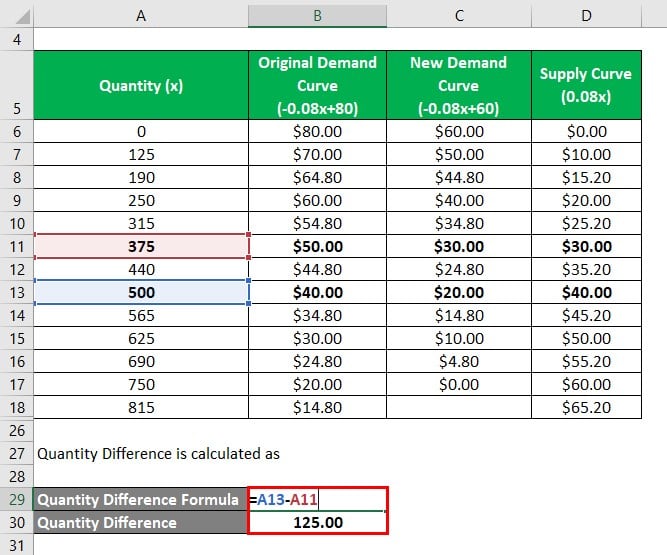

Deadweight Loss Formula How To Calculate Deadweight Loss

Bfiltqjc Ibeqm

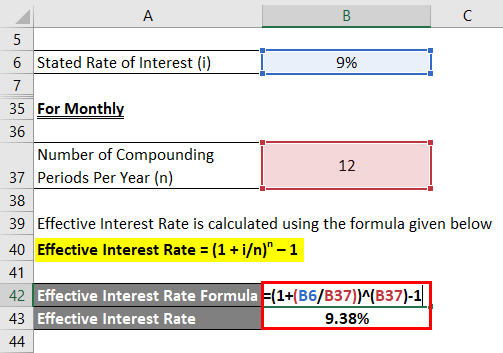

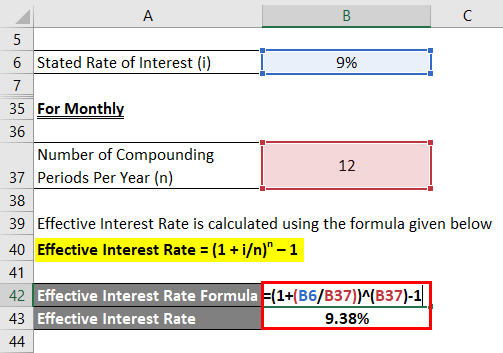

Effective Interest Rate Formula Calculator With Excel Template

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

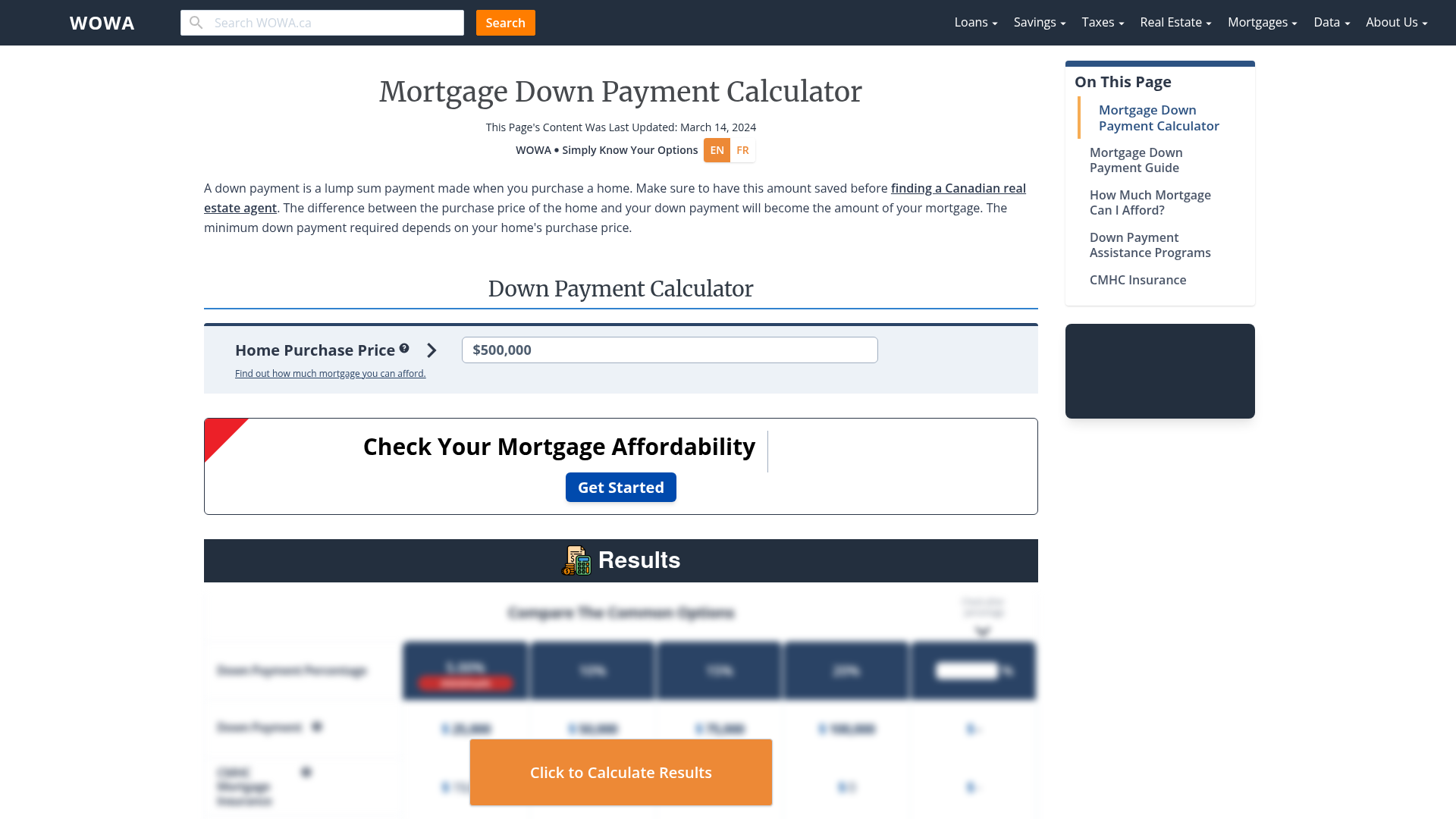

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Ssjtafrpq7xz M

Bitbuy Review 2022 Comparewise

How To Use A Mortgage Calculator Comparewise

What Is Home Equity Wowa Ca

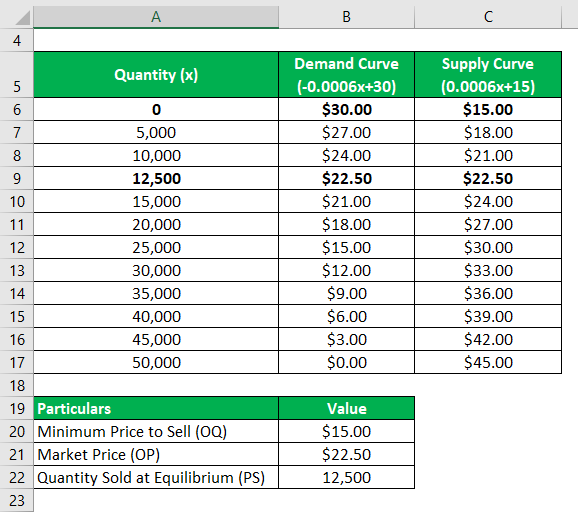

Producer Surplus Formula Calculator Examples With Excel Template

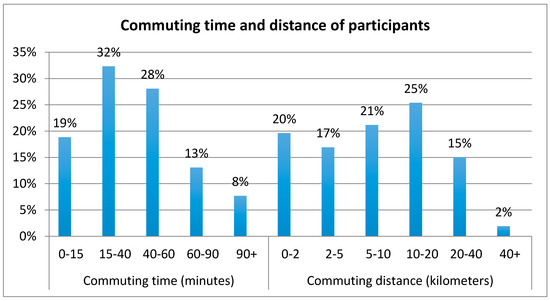

Urban Science Free Full Text Sharing And Riding How The Dockless Bike Sharing Scheme In China Shapes The City Html

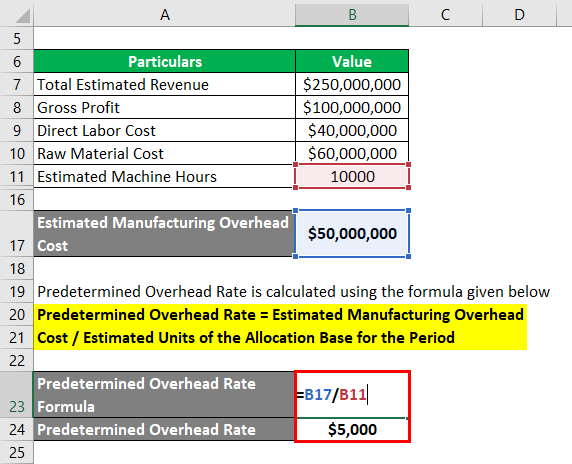

Predetermined Overhead Rate Formula Calculator With Excel Template

Worthwhile Canadian Initiative The Basic Arithmetic Of Rrsps And Tfsas

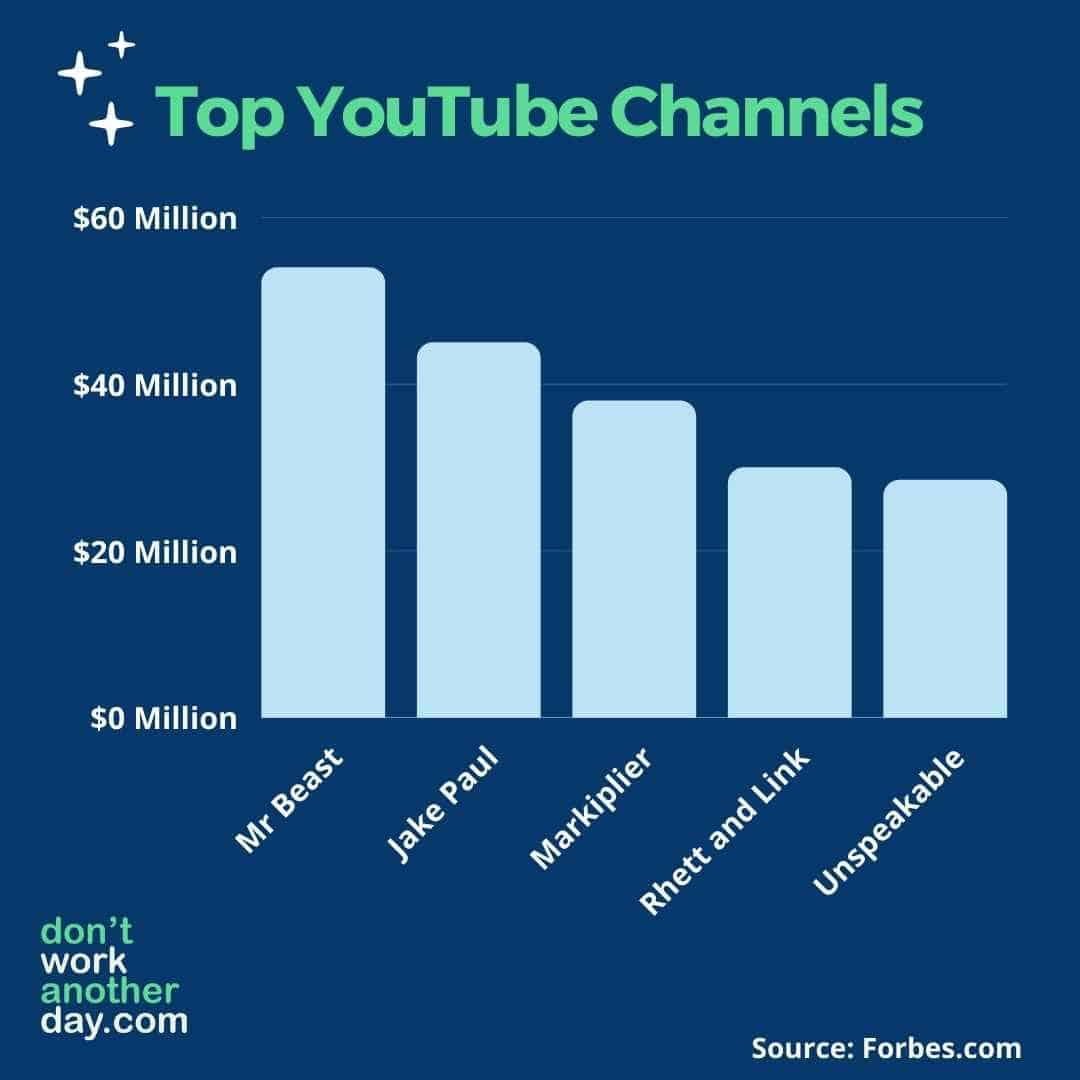

40 Easy Ways To Make 50 A Day Ultimate 2022 Guide

Worthwhile Canadian Initiative The Basic Arithmetic Of Rrsps And Tfsas